crypto tax calculator australia

At Crypto Tax Calculator Australia we support and strongly believe in customer privacy. Are you prepared for tax season.

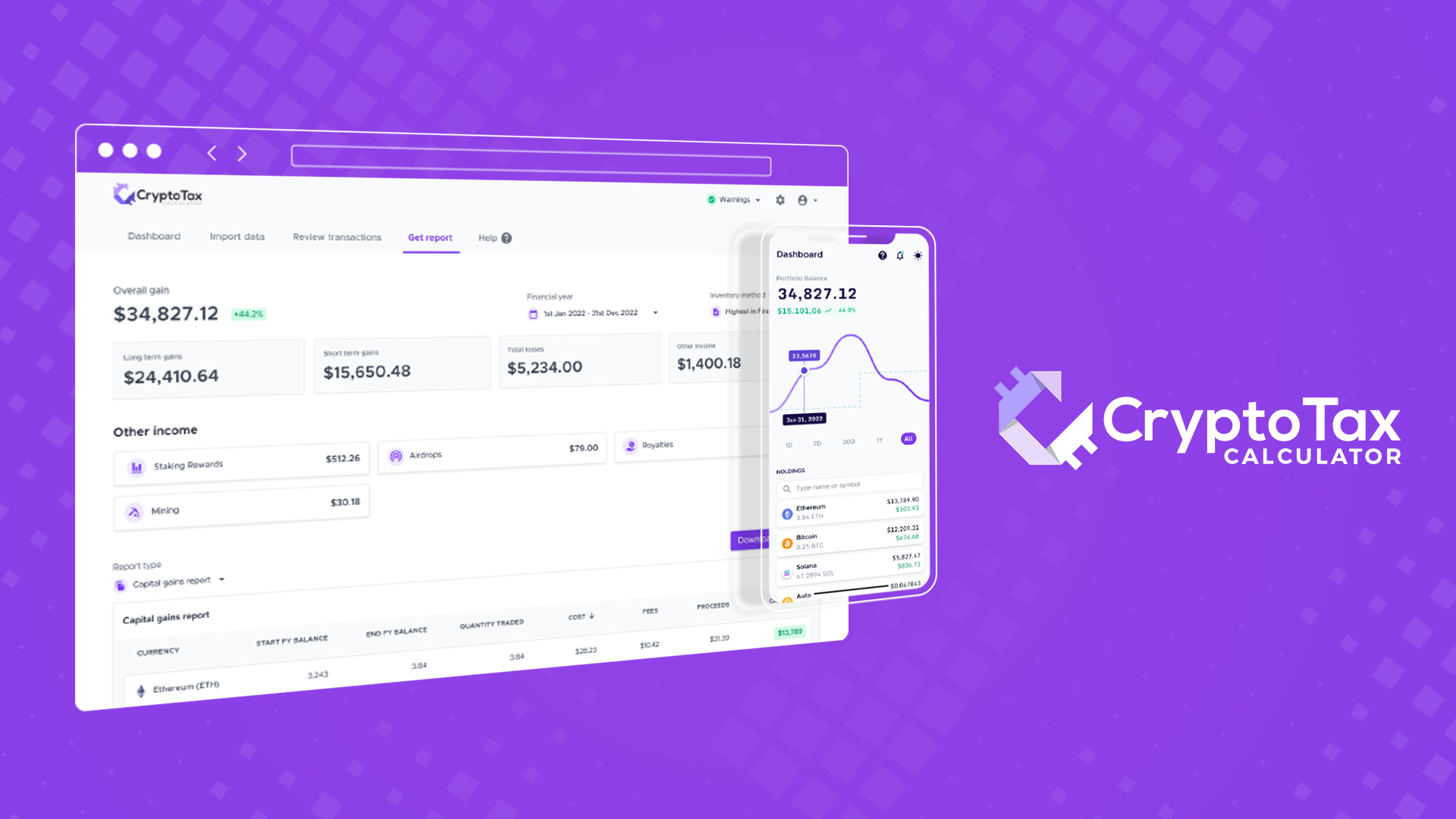

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

How Are Cryptocurrencies Taxed.

. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes. Discover how much taxes you may owe in 2021. At Crypto Tax Calculator Australia their state of the art application makes calculating cryptocurrency tax easy whether you are a beginner trader or a crypto trading master.

As Tim Brunette co-founder of Crypto Tax Calculator an Australian startup that has leapt up in the crypto-adjacent space recently told DMARGE crypto is gaining greater cultural purchase. No expiry date on the use of the first 50 reports. Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports.

All have pros and cons - but for me with a lot of defi transactions I have to say cryptotaxcalculator has been the easiest especially for those in Fantom DEFI. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. 8500 upfront for 50 reports and 185 per report thereafter.

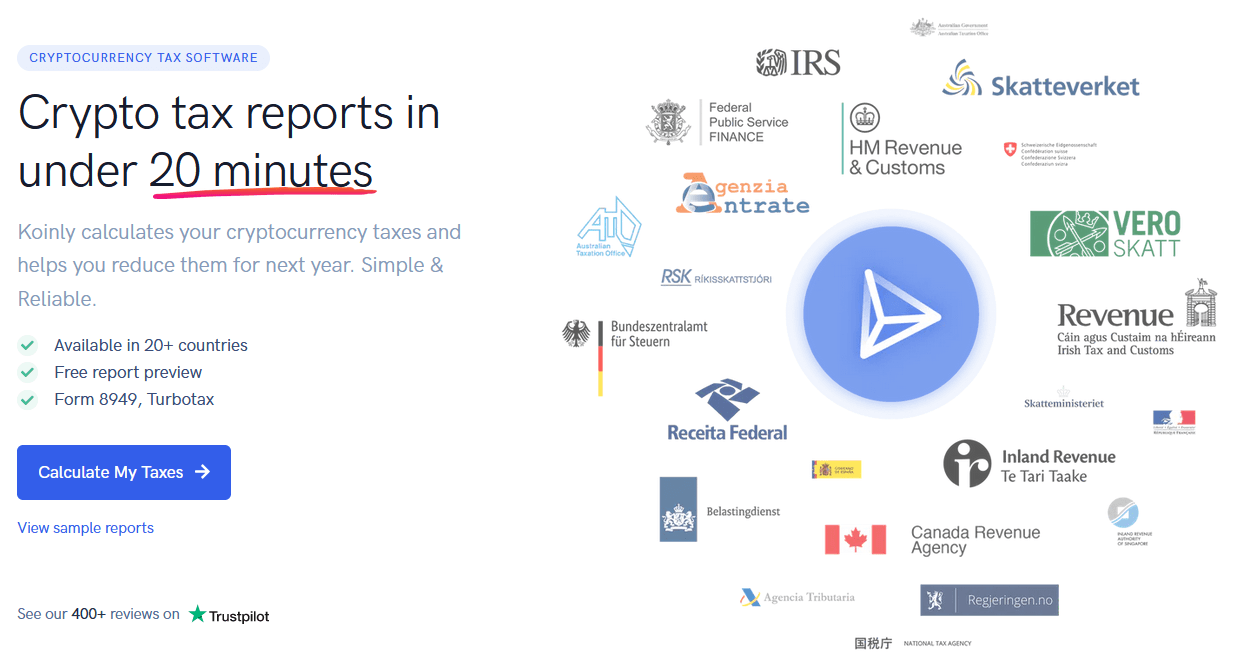

Tokentax is not just a crypto tax calculator software. Get help with your crypto tax reports. Best Tax Software Crypto For Complex Filing.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. You can use a crypto tax calculator to help you with the calculations. This means you can get your tax details up to date yourself allowing you to save significant time and reduce the bill charged by your accountant or tax agent.

Therefore our crypto tax application does not store or keep your crypto data. Next Steps - Australia Crypto Tax. Read The Ultimate Crypto Tax Guide.

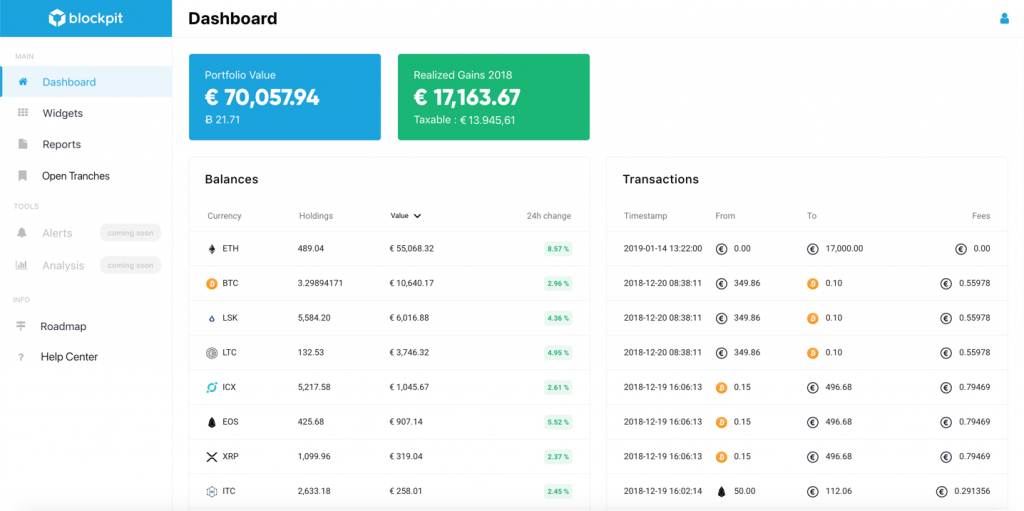

The Australian Tax Office classifies cryptocurrency as a property or a capital gains tax asset. Crypto Tax Calculator Australia prides itself on making it simple and easy for you the customer to use our top of the range service and application when it. Crypto Tax Calculator Australia Calculating your crypto tax in Australia can be quite a daunting experience at first glance however it does not need to be.

The following article will explain how crypto is taxed in Australia and the best practices to calculate your cryptocurrency taxes. The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of. Affordable plans for everyone.

In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about the cryptocurrency asset you have. It is possible for you to pay capital gains taxes at your normal income tax rate of 10 to 37 if you hold your cryptocurrency fewer than one yearFor transactions held over a year capital gains taxes are. If you are an Australian trading with cryptocurrency or.

Demystify Crypto Taxes All blog post Tag. CryptoTaxCalculator Partners With CoinSpot. As with most other countries Australians calculate their taxes owed based on the fiat value of the crypto at the time of the transaction.

Our crypto tax calculator plans can cost less per year then a subscription to a streaming service. The Crypto Tax Calculator Australia website is a fantastic software application for anyone in Australia that has made cryptocurrency transactions and needs to calculate their taxes owed on those transactions. Simply upload or add the transaction from the exchanges and wallets you have used along with any crypto you might already own and well calculate your capital gains.

You simply import all your transaction history and export your report. Start from your myTax account available from your myGov dashboard. Log in Sign Up.

Crypto Tax Calculator Australia offers package deals with SMSF Accountants or accounting firms as a whole. At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously. Its also a full-fledged crypto tax accounting firm making its services much.

How Is Crypto Tax Calculated. Crypto Tax Calculator for Australia. Using The Australian Cryptocurrency Tax Calculator.

CryptoTaxCalculator has partnered with leading Australian cryptocurrency exchange CoinSpot offering seamless integration between the two productsBeing one of the earliest fully featured trading platforms that facilitate crypto to crypto transactions it exciting for us to offer complete support for CoinSpot users. You simply review your crypto transactions that you wish to export from your current exchange eg BTC Markets and export this data as a CSV file which is then saved to your device. You can import data for all the Cryptocurrencies you have traded with and our application will combine them all into one report.

To use a crypto tax calculator you should understand the basics of how crypto tax is. Crypto Tax Calculator. This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements.

This application makes it easy to calculate your taxes in a simple and easy way. 200 per report payment upfront by credit card or direct debit. Best tool to manage my crypto tax in Australia I have spent a while doing some comparisons on good crypto accounting tools - looking at koinly cointracker and cryptotaxcalculator CTC for trading.

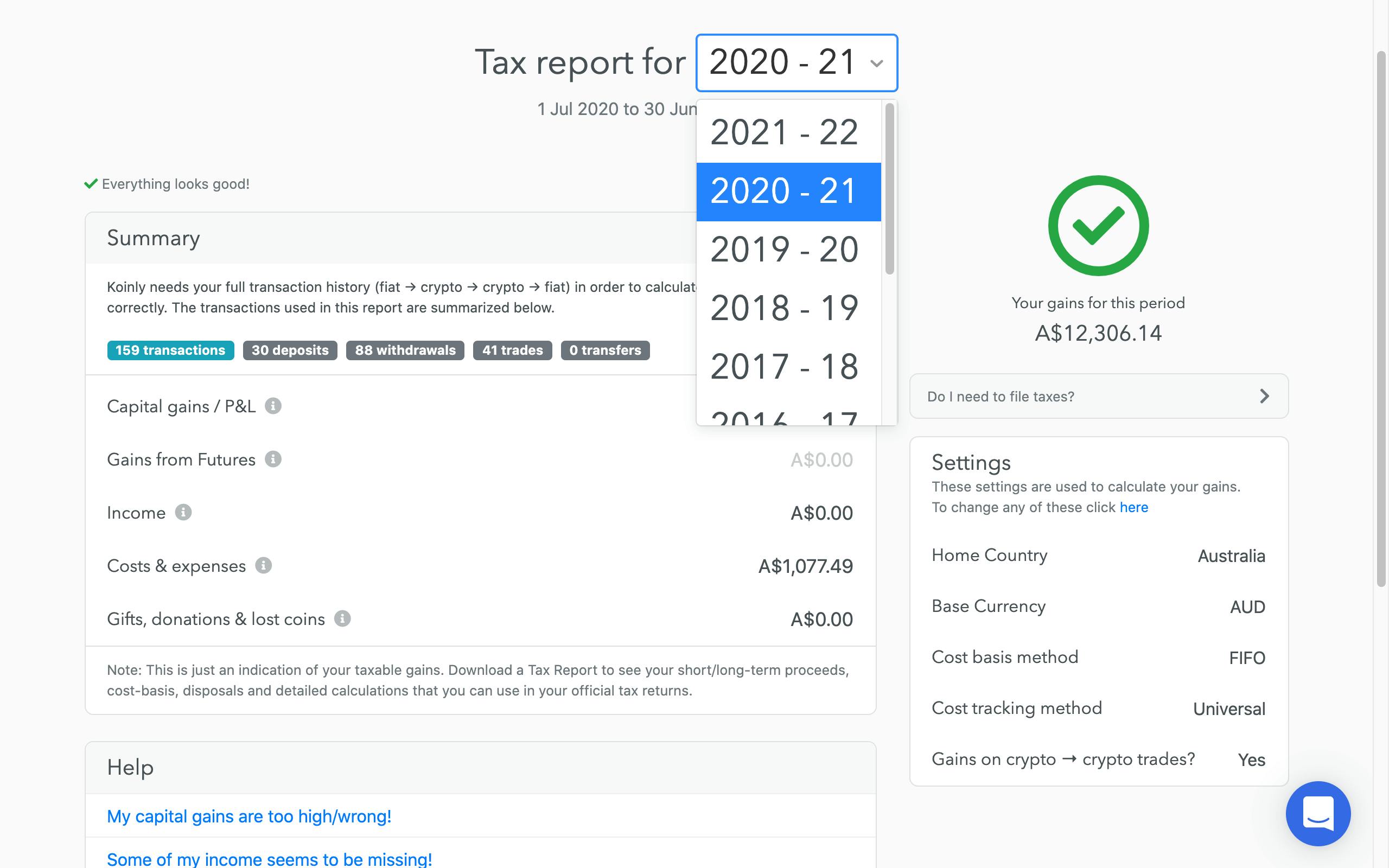

Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. Once you or your accountant have calculated your crypto tax totals we have an app for that the easiest way to file your taxes in Australia is online using myTax available from your myGov dashboard.

Australia S Cryptotaxcalculator Helps Traders Demystify The Decentralized Techcrunch

![]()

Cointracking Crypto Tax Calculator

Koinly Crypto Tax Calculator For Australia Nz

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Crypto Tax Calculator Gnosis Chain

Next Steps Australia Crypto Tax Report Cryptotrader Tax

Cryptocurrency Tax Software Crpytotrader Tax Now Available In Australia Bitcoin Com Au

Crypto Tax In Australia The Definitive 2021 2022 Guide

The Ultimate Australia Crypto Tax Guide 2022 Koinly

![]()

Cointracking Crypto Tax Calculator

Crypto Tax Calculator Review April 2022 Finder Com

5 Best Crypto Tax Software Accounting Calculators 2022

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Free Crypto Tax Calculator 2022 Online Tool Haru

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Top 10 Crypto Tax Return Software For Australia Crypto News Au